2023 was a tough year for Kraft Foods, or The Kraft Heinz Company (KHC). The company and its peers struggled compared to the rest of the market, with KHC in particular seeing a 9% drop.

However, things began to turn towards the end of the year. This stock has rallied nearly 20% in the past 3 months, and there’s reason to believe now might be the right time to buy KHC.

Just a couple of months ago Kraft lifted its earnings outlook, suggesting that there was light at the end of the tunnel. However, investors and analysts chose to remain pessimistic about the stock – a 2% sales growth was unsatisfactory, especially considering that this was mainly a result of raising prices.

Meanwhile, there was more to be excited about than investors realized. Management pointed to positive trends in operating and financial performance, with cost cuts raising profits. The company also exhibited fairly solid cash flow.

Kraft has even made impressive efforts to chisel away at its debt over the past year. Climbing out of that hole was a major objective for the company, and the work put in during 2023 has set the stage for a solid year ahead in regard to earnings and profitability.

That being said, the company is still cautious regarding its short-term outlook. Organic sales growth will remain underwhelming, coming in at the low end of its previous guidance – somewhere between 4-6%.

While Wall Street won’t change its stance until it sees rising sales growth attributed to an increase in volume (rather than price hikes), you can be early to the party. We’ve taken a look at KHC in the VectorVest stock analysis software and uncovered 3 compelling reasons to consider buying this stock now.

KHC Has Fair Upside Potential and Safety With Good Timing

VectorVest is a proprietary stock rating system that has outperformed the S&P 500 index by 10x over the past 20 years and counting. It saves you time and stress while empowering you to win more trades. How does it work?

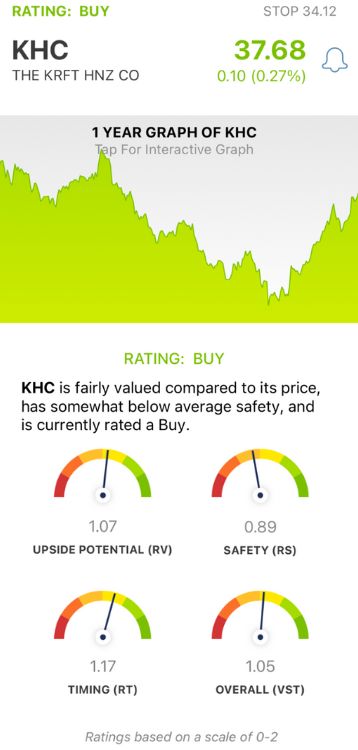

Simple - you’re given clear, actionable insights in just 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

It gets even better, though. You’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for KHC, here’s what you need to see:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out) to AAA corporate bond rates and risk. This offers much better insight than a simple comparison of price to value alone. KHC has a fair RV rating of 1.07 right now.

- Fair Safety: KHC is a fairly safe stock, too, with an RS rating of 0.89 - albeit a ways below the average. This risk indicator is derived from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. As KHC delivers better earnings in the year ahead, this rating should become more favorable.

- Good Timing: Despite a poor performance in 2023, the stock is off to a solid start in 2024. The positive price trend for KHC is reflected in a good RT rating of 1.17. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.05 is considered fair, and it’s enough to earn KHC a BUY recommendation in the VectorVest system today. Learn more about this opportunity through a free stock analysis - you're not going to want to miss out on this one!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. KHC is up nearly 20% in the past few months and looks to be poised for a solid 2024. The stock has fair upside potential and safety with good timing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment