Boeing (BA) has been trying to purchase Spirit Aerosystems (SPR) for months now, and it looks like the deal has finally come to fruition. The two companies agreed to an all-stock deal for a valuation of $4.7 billion.

This puts the airplane part manufacturer at $37.25 per share, whereas the company currently sits at just $33.80 per share after gaining 3% so far today. BA is up just under 2% on the news.

Spirit Aerosystems has been one of Boeing’s primary suppliers since it spun off from the airplane manufacturer back in 2005. But, executives with the company have admitted that selling the company was a huge mistake – one that is still coming back to bite them today.

Spirit’s parts were allegedly responsible for the door panel blowout on an Alaska Airways 737 Max at the start of this year, which launched another investigation into the safety practices going on at Boeing.

This led to a probe back into the fatal crashes of two Boeing planes back in 2018 and 2019 – which is still ongoing today. The DOJ is in the midst of determining whether or not Boeing breached a contract related to the original settlement or not.

At any rate, Boeing believes that consolidating Spirit back into its ecosystem will help improve safety with a closer eye on quality control of part manufacturing. CEO Dave Calhoun says everyone benefits from the deal – airline customers, Boeing and Spirit employees, and the country as a whole.

Spirit also manufactures parts for Airbus, and Boeing was hoping to get better terms on the deal because of this. But, with the DOJ heat turned all the way up, Boeing was backed into a corner and forced to make whatever deal they could. All major activities related to Airbus are being purchased for a nominal $1.

BA has now fallen 28% through 2024 thus far, and it has felt like one thing after another for the airline manufacturer. Is this deal enough to finally turn things around?

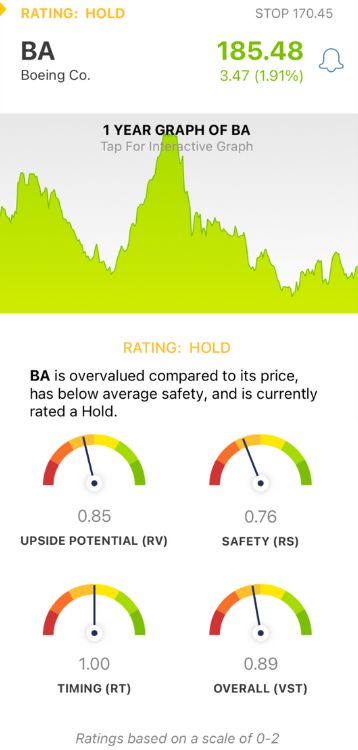

We’ve taken a look through the VectorVest stock software, and purely from a stock analysis standpoint, we still see a few major issues with BA. Here’s what you need to know…

BA Has Fair Upside Potential and Timing, But Poor Safety Holding it Back

VectorVest is a proprietary stock rating system that saves you time and stress by delivering clear, actionable insights in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. You’re even given a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s what we found for BA right now:

- Fair Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers far superior insight than the typical comparison of price to value alone. As for BA, the RV rating of 0.85 is a ways below the average, but deemed fair nonetheless.

- Poor Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. BA has a poor RS rating of 0.76.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. Even though the stock has tanked this year, BA still has a fair RT rating right at the average of 1.00.

The overall VST rating of 0.89 is deemed fair for BA, and the stock is rated a HOLD in the VectorVest system right now. If you’re a current investor or looking for an opportunity to trade this stock, take a moment to map out your next move with this free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. BA has finally reached a deal to acquire Spirit Aerosystems, a major supplier, in an effort to ramp up the safety and quality of its planes. The stock itself has poor safety with fair upside potential and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment