Tesla Inc. (TSLA) shares jumped an impressive 14.5% following Donald Trump’s recent election victory, reaching $287.93, marking a significant moment for the electric vehicle maker. This surge pushed Tesla’s market cap above $900 billion for the first time since July 2023.

Investors are feeling optimistic about what Donald Trump’s election could mean for Tesla, especially given CEO Elon Musk’s close relationship with him. When Trump celebrated his victory, he couldn’t help but shine a spotlight on Musk, calling him a “super genius.” This kind of praise could lead to a more supportive regulatory environment for Tesla, and investors are hopeful that the company will reap the benefits of having a friend in the White House.

It’s worth mentioning that a Republican administration could bring cuts to electric vehicle incentives, which might pose some hurdles for the entire EV market. However, Wedbush analyst Dan Ives remains optimistic, believing that Tesla’s solid footing in the industry will enable it to thrive even without those subsidies. He even thinks that Trump’s presidency could potentially add $40 to $50 per share to Tesla’s stock if it can navigate fewer regulatory hurdles for its ambitious self-driving technologies. While the road ahead might be bumpy for other automakers, Tesla seems well-equipped to capture a larger slice of the market as the landscape shifts.

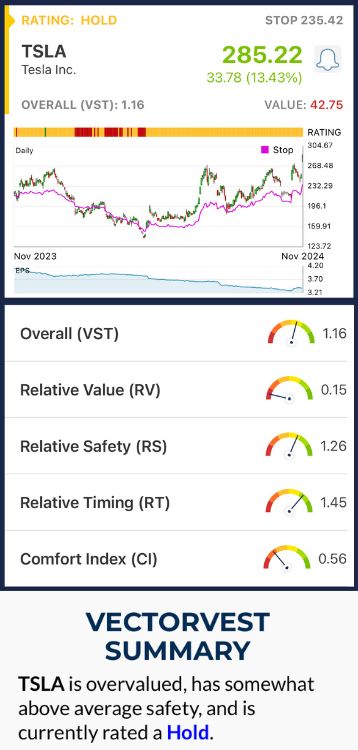

TSLA Has Poor Upside Potential, but Very Good Safety and Excellent Timing

VectorVest is a proprietary stock rating system that distills complex technical and fundamental data into clear, actionable insights through three simple ratings. This system helps you make calculated, emotionless investment decisions quickly.

The ratings are relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on a scale of 0.00-2.00, with 1.00 being the average, allowing for quick interpretation. Here’s what we found for TSLA:

- Poor Upside Potential: The RV rating, which compares a stock’s long-term price appreciation potential (based on a 3-year forecast), AAA corporate bond rates, and risk, shows TSLA with an RV of 0.15, indicating very poor long-term price appreciation potential.

- Very Good Safety: The RS rating is a risk indicator derived from an analysis of the company’s financial consistency, predictability, debt-to-equity ratio, sales volume, and price volatility. TSLA has an RS rating of 1.26, which is considered very good.

- Excellent Timing: The RT rating reflects the direction, dynamics, and magnitude of the stock’s price movement. TSLA's RT rating stands at 1.45, indicating excellent timing and strong momentum in the stock’s price movements.

The overall VST rating of 1.16 is good for TSLA, and the stock is currently rated a HOLD in the VectorVest system. Before you make your next move, take a moment to review this free stock analysis to gain deeper insights and prepare for your trading decisions!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks that are rising in price. TSLA stock has seen a significant increase following the election results, but while there are concerns regarding potential regulatory changes, the company maintains good safety and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment