Written by: Angela Akers

Crypto has been flying high since the results of the election. The reason should not be a surprise. Throughout his campaign, President re-elect Trump openly supported Bitcoin and touted that he’d like to make the US the “crypto capital of the planet.”

This week, it became apparent that the 47th President was going to make every attempt to make good on that campaign promise. He announced plans to nominate an outspoken crypto advocate, Cantor Fitzgerald’s CEO, Howard Lutnick, to head the Department of Commerce. Additionally, President re-elect Trump met with Coinbase CEO Brian Armstrong, and it was revealed that Trump Media (DJT) is closing in on a deal to buy Bakkt (a cryptocurrency trading platform). To add to that, the potential for the first White House crypto role became a tangible reality as Trump considered a crypto czar.

Bitcoin was trading at $98,401 today, closing in on $100,000, up 44.03% in the 17 short days since election day when it was trading at $68,318. So, the move in Bitcoin has been extraordinary. As investors, Bitcoin is an option, but that is currency. Let’s talk about how to play the move in crypto with Stocks and ETFs with a little help from VectorVest.

Here are a couple of resources we can use in VectorVest 7:

- Under the Industry Viewer, you can find the Financial (Crypto Stocks) industry.

- In the UniSearch tool, under Searches – Special Searches, there is a CryptoCurrency Stocks search.

- On September 10, 2021, we created a WatchList named Cryptocurrency Stocks,

in the Special WatchLists folder that contains everything from blockchain mining to virtual wallets to chip manufacturers to brokers and other financial companies involved with crypto.

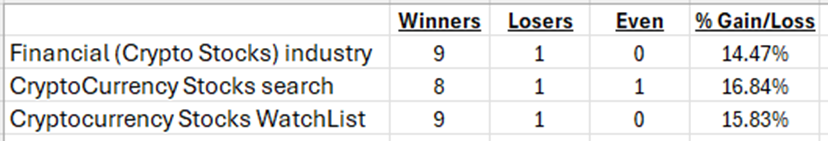

I ran some QuickTests from November 5th’s close through yesterday’s close just using VectorVest’s default sort, VST Desc., to see how these resources would have served us. Here are the results:

OK, not bad, but I was sure that VectorVest could help me compete with Bitcoin’s rise. Because I have been seeing articles about Bitcoin-focused ETFs soaring, I wondered how a WatchList of just crypto ETFs would fare; especially with VectorVest’s proprietary default sort to help me pick the right candidates. My colleague Michelle and I set out to find all the crypto-focused ETFs and managed to build a WatchList of 66 Crypto ETFs.** It has been added to our Special WatchLists folder for your perusal. A QuickTest of the top 10 ETFs in this WatchList sorted by VST Desc from November 5th’s close through yesterday’s close showed the following:

WOW! I really like those results!

While there is no telling what the future holds, one thing I do know is that if Bitcoin and crypto continue to climb, VectorVest will help you Win With Crypto.

**Please be aware that several of the crypto-focused ETFs are leveraged ETFs. Investors must be aware that while leveraged ETFs have the potential for increased gains, they also have the potential for increased losses. Make sure that you have Stops in place for all of your trades, but particularly when leverage is a concern.

PS. In this week’s “Special Presentation,” Mr. Ryan Shook will be taking you inside VectorVest to show you ways to capitalize on the reinvigorated crypto craze and you won’t want to miss it!!!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment