Written by: Mike Simonato, Ontario Presenter: “My Three Friends”, Dec. 3, 2016, VectorVest International Online User Group (Click here to View: My Three Friends)

I’m new at this but I find it very interesting how the entire world seems to be flip-flopping between C/UP and C/DN at the same Time:

USA & Europe C/Up Tuesday, Canada, England and Australia C/UP Wednesday

DOW JONES: Stuck at Feb High. This week in a tight channel. Tried to breakout Monday but failed. Tried to downside Thursday but failed. Volume Falling

NASDAQ: Failed at Sept 2 level but holding the 8 EMA. Volume better but I want a breakout above Sept 2 level before I get too excited.

S&P 500: Same setup as Dow.

MKT TIMING: Same setup as Dow and S&P 500 however this tight channel is different since the bottom of the channel is higher than previous support. RT, BSR and MTI all rising nicely.

READ Views, Strategy, Climate Earnings Indicator continues to inch up. Big jump now in %Bullish Advisors.

CANADA

PTSE: Got scared at previous high but holding the 3 EMA. RT rising but volume falling.

VENTURE: Broke above the downward trendline. Came back and retested and now rising on increasing volume (Bullish).

MKT TIMING: Broke above resistance and now resting the last 3 days. RT, BSR and MTI rising.

READ VIEWS – Strategy, Climate Earnings Indicator still flat in Canada

NOTE As I have mentioned before, the 4th quarter of 2020 and the first quarter of 2021 are the numbers I’ll be watching as I believe they will be the first numbers that haven’t been heavily manipulated.

Seriously, is there a camera hidden in my house somewhere?

About a month ago Wall Street told me to look at Green Energy, Since I was still working 7 days a week and didn’t have a clue how to do that yet I emailed our resident expert Steve T. for help and advice. He sent me an amazing list of Canadian Stocks on the subject so I did what I always do and created a watchlist.

(Very Important to do this) This morning after reading Stan’s Views I added his recs as well. I also got some USA stocks from Glenn Tomkins from the VectorVest Facebook page and the USA Views from yesterday. (here is the complete list USA ENPH, REGI, WKHS, NIO, FSR, CANADA PYR, BLDP, BLX, NPI, INE, RNW, BEP.U, AQN, PIF, PL)

Then this is what I do:

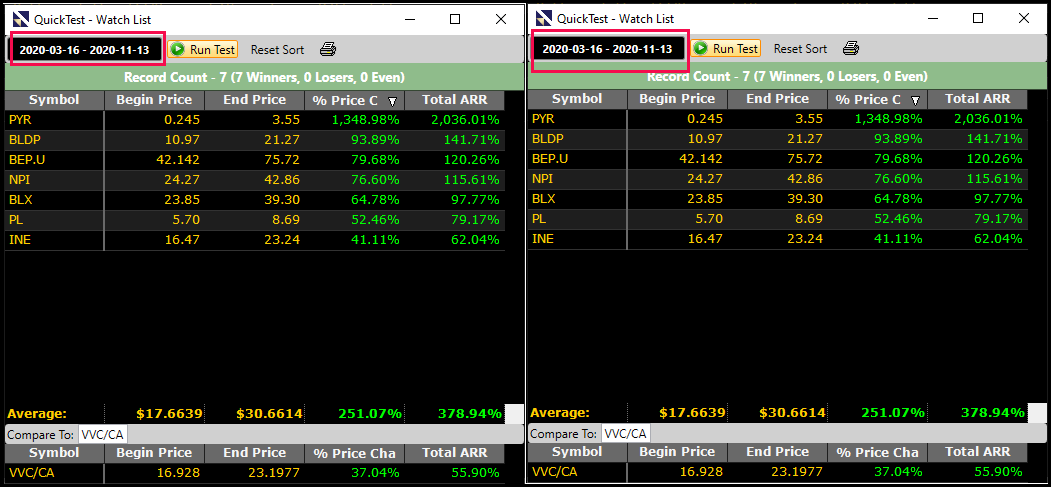

Since this year is a little unique I did 4 Quick Tests:

- Jan 2 2020 to date

- Mar 16 to date (Virus era)

- Aug 28 to date (When I took action to protect)

- Election to date

I did this for both the USA and CDN Watchlists See attachments for the results.

NOTE I also look at the Watchlist Average Graphs looking for smoothness. I follow this procedure any time I’m considering a stock, ETF, sector or industry.

I will of course look at the individual stock/ etf graph before any purchase to see if it meets my criteria. I usually buy just before it falls.

I eliminate any that don’t perform well but sometimes will keep one that is weak in the longer term quicktest but has done really well in the more recent quick tests.

You will likely want to do as Stan mentioned in the views and set up a Quick Folio to track performance. Note the difference between Canada and the USA in the more recent quicktest and the heavy selling the last 2 days.

As always nothing more than my 2 cents and I hope it’s of value and interest.

Leave A Comment