Written by: Angela Akers

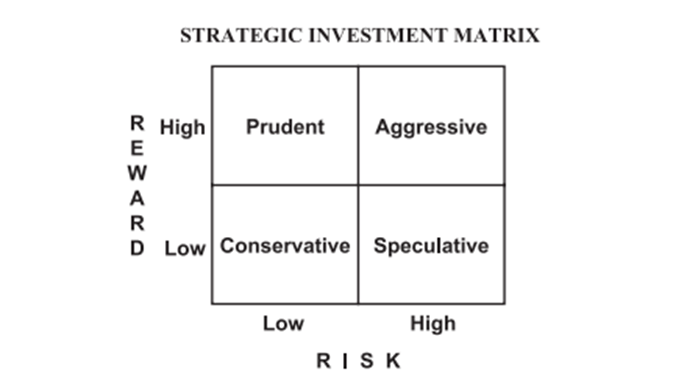

Over the last two weeks, we have been reviewing investment styles and how to pick stocks that are consistent with each style. Dr. DiLiddo reviews these in Chapter 12 of “Stocks, Strategies & Common Sense” which is aptly named, “Investment Styles & Strategies” where he introduces the VectorVest Investment Matrix. History has shown that it is imperative to know your investment style and buy stocks that are consistent with that style to be a successful investor.

The four basic investment styles listed above can be categorized by using two of our key proprietary fundamental indicators, Relative Value, RV, which measures the long-term price appreciation potential of a company and Relative Safety, RS, which is an indicator of risk and measures the consistency and predictability of a company’s financial performance. Both of these indicators are measured on a 0.00 – 2.00 scale with values above 1.00 being favorable and values below 1.00 being unfavorable.

If you’re not familiar with these indicators, here are some quick refreshers:

Two weeks ago, we covered the Aggressive Investor, ie. the high risk, high reward investor. Last week, we reviewed the Conservative Investor, ie. the low risk, low reward investor. This week, we’ll talk about the Prudent Investor.

Prudent Investors are goldilocks investors. They want it all. Prudent Investors are looking for a high reward but don’t really want to take on much risk. This is where I land in the Investment Matrix. I want to beat the market year-after-year, but I want to do it safely. The stocks that fall in line with the Prudent investment style are characterized in VectorVest by having a Relative Value, RV, above 1.00 and a Relative Safety, RS, above 1.00, ie. safe stocks with consistent, predictable earnings and good price appreciation potential. Because Prudent Investors want to beat the market, a double-digit Growth Rate, GRT, that is greater than the sum of long-term interest and inflation rates is vital. An example of this is currently, the Consumer Price Inflation stands at 3.40% and Long-term AAA Corporate Bonds are at 5.37%, which would be a combined 8.77%, so a GRT of 10% or more would be preferred.

As with the two styles we have previously discussed, it is also easy to locate stocks that fit the Prudent style of investing in VectorVest. Just click on the UniSearch tab of VV7 and select the Searches – Prudent group from the list on the lefthand side of the screen. You’ll find 31 Searches in this list that will help you find the best stocks to fit the Prudent investment style. Additionally, as a Prudent Investor, you’ll only want to buy stocks when the market is rising. For Prudent Investors, the appropriate Market Timing systems to use for buying stocks are the Green Light Buyer, GLB/RT Kicker, DEW Up or Conservative Confirmed Up Call depending on how “Prudent” you are.

Make sure you watch tonight’s “Special Presentation” where Mr. Jerry D’Ambrosio will take you through the Prudent approach. Are You A Prudent Investor?

PS. Don’t forget we’re offering our Retirement Portfolio Transformation for the first time ever FREE to all of our VectorVest subscribers! If you’re serious about capital preservation, generating income and learning how to grow your account safely and securely, click here for more information or to sign up. Don’t miss this opportunity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment