Adobe Inc. (ADBE) released its fiscal year 2024 fourth-quarter earnings report, exceeding expectations for both revenue and earnings. But while the results impressed on paper, weak forward guidance has taken center stage, rattling investors. Here’s a breakdown of the company’s Q4 performance:

- Adjusted earnings per share: $4.81 compared to the $4.67 analyst consensus.

- Revenue: $5.61 billion compared to the $5.54 billion consensus.

- Digital Media revenue: Up 12% year-over-year to $4.2 billion, driven by Creative Cloud and Document Cloud subscriptions.

CEO Shantanu Narayen highlighted Adobe’s continued innovation and the “mission-critical role” its offerings, including Creative Cloud, Document Cloud, and Experience Cloud, play in the AI economy. The company also pointed to strong growth in digital media annualized recurring revenue (ARR), which climbed to $17.33 billion, with monthly active users rising 25% year-over-year to 650 million.

Despite these strong results, Adobe’s forward guidance has raised concerns. For the first quarter of fiscal 2025, Adobe anticipates revenue between $5.63 billion and $5.68 billion, below analysts’ expectations of $5.72 billion. Its full-year revenue projection of $23.3 billion to $23.55 billion also fell short of Wall Street’s $23.8 billion estimate.

As a result, Adobe shares have plunged more than 10% in premarket trading and are down approximately 8% for the year. Analysts are skeptical about Adobe’s ability to monetize its generative AI investments effectively, especially given rising competition from Stability AI and MidJourney. The company’s AI-driven tools are showing promise, but the lack of clear financial metrics for these innovations continues to weigh on investor confidence.

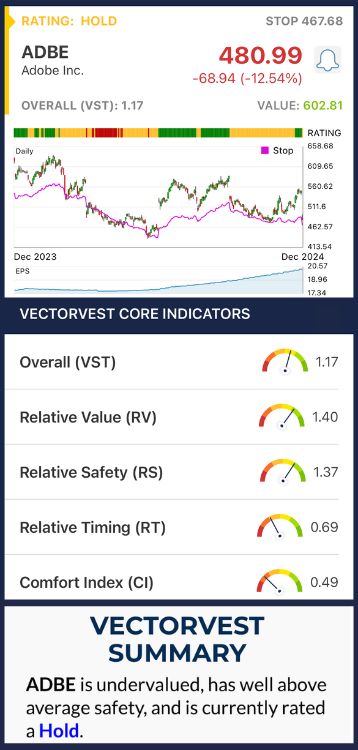

ADBE Has Good Upside Potential, Excellent Safety, and Poor Timing

VectorVest is a proprietary stock rating system that distills complex technical and fundamental data into 3 simple ratings, saving you time and stress while empowering you to make informed investment decisions.

These ratings are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00–2.00, with 1.00 being the average, making interpretation quick and easy.

You’re also provided with a clear buy, sell, or hold recommendation for any stock based on its overall VST rating. Here’s what you need to know about ADBE:

- Very Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This superior indicator goes beyond simple price-to-value comparisons. ADBE has a strong RV rating of 1.40, reflecting its solid growth potential over the long term.

- Very Good Safety: The RS rating is a risk indicator derived from the company’s financial consistency, predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. Adobe’s RS rating of 1.37 demonstrates its above-average stability and strong financial foundation.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. ADBE has a poor RT rating of 0.69 right now after its performance today.

With an overall VST rating of 1.17, ADBE is rated a Hold. While the company’s long-term fundamentals remain strong, its near-term performance has been affected by investor concerns about the pace of AI monetization and forward revenue guidance.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks that are rising in price. ADBE is down over 10% so far Thursday after delivering downtrodden guidance for Q1 2025 despite outperforming in Q4. The stock itself has very good upside potential and safety, although poor timing is holding it back right now

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment