Shares of Taiwan Semiconductor Manufacturing Company (TSM) got a 3% boost Monday morning after analysts with Morgan Stanley were the latest to upgrade the stock.

The company is set to release its earnings on July 18th, and more and more experts are paying attention to the stock as the date approaches – you should too. TSM plays a pivotal role in powering companies like Apple, Nvidia, and more.

Morgan Stanley set its price target 9% higher as it suspects the company will raise its earnings forecast for the full year. Analysts also believe the company could raise its prices even higher on wafers given its position in the market.

One expert of note, Charlie Chan, says that the company has implemented an effective hunger marketing strategy. This, coupled with the fact that supply is going to become tighter and tighter for leading-edge foundries heading into 2025, puts TSM in a position to win.

JPMorgan also sees an upside in the stock, with experts expecting revenue guidance to come in higher on the earnings call as well. Analyst Gokul Hariharan says that the company will likely be upbeat on demand for AI acceleration, for which it’s a key player.

While the expectation is that TSM could post revenue growth of 36% year over year, it wouldn’t come as much of a surprise to see them outperform this estimate.

The stock itself is on pace to reach the coveted $1 trillion market cap thanks to the rally so far in 2024. It’s up 84% year to date and 7% in the last week alone. We’ve taken a deeper look at TSM through the VectorVest stock software and see 3 specific reasons to buy this stock today.

TSM Has Good Upside Potential With Excellent Safety and Timing

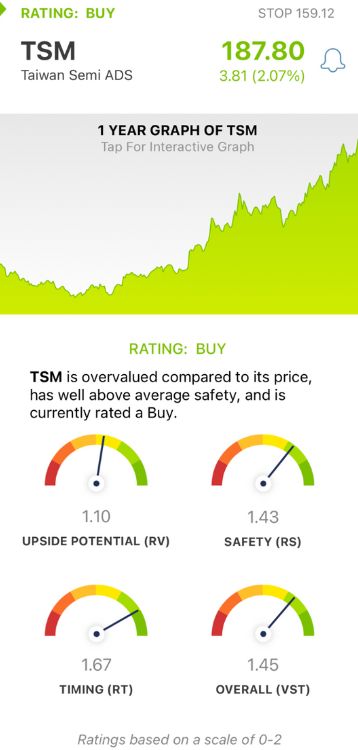

VectorVest is a proprietary stock rating system that takes complex technical indicators and distills them into clear, actionable insights. You’re given everything you need to know to make calculated decisions in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. Just pick safe, undervalued stocks rising in price to win more trades with less work! Or, simply follow the buy, sell, or hold recommendation VectorVest issues for any given stock at any given time. Here’s what we uncovered for TSM:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This is a much better indicator than the typical comparison of price to value alone. TSM has a good RV rating of 1.10.

- Excellent Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.43 is excellent for TSM.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.67 is excellent for TSM, reflecting its performance in both the short and long term.

The overall VST rating of 1.45 is excellent for TSM and enough to earn the stock a BUY recommendation in the VectorVest system.

But before you do anything else, take a moment to look through this free stock analysis to set yourself up for the most profitable trade possible. Transform your trading strategy with VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. TSM is climbing higher today, adding to its impressive rally over the past year. This comes as analysts from a variety of firms, Morgan Stanley, JPMorgan, and more, upgrade their outlook ahead of the company’s upcoming earnings. The stock itself has good upside potential with excellent safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment