Shares of Super Micro Computer (SMCI) have taken a steep fall, dropping over 40% after news broke that Ernst & Young (EY), the company’s auditor, has resigned. This comes on the heels of a DOJ probe, raising serious questions for investors.

SMCI’s tumble this past week has added to its already shaky year. While the AI server maker has shown potential with its cutting-edge technology, it is now facing scrutiny over its financial practices. Here’s a deeper dive into what’s happening with SMCI and what you, as an investor, need to consider.

A Troubling History of Accounting Issues

SMCI’s current situation isn’t coming out of nowhere. The company has a history that goes back to 2017 when it delayed financial reports and conducted an internal audit, leading to the exit of key executives, including its CFO. By 2020, SMCI had settled with the SEC over “widespread accounting violations,” including prematurely reported revenue and misuse of a marketing program. This resulted in a $17.5 million fine, while the CFO paid over $260,000.

Fast forward to now: these past issues have come back to haunt the company, as new allegations and concerns over internal practices emerge.

Hindenburg and DOJ Weigh In

In August, the short-seller Hindenburg Research published a report claiming SMCI continued some questionable practices and even violated sanctions by selling equipment to Russia post-invasion of Ukraine. Although these are allegations, they’re serious enough to impact market sentiment, especially when combined with the recent Department of Justice (DOJ) probe.

Just a few weeks ago, news surfaced that the DOJ was investigating SMCI, further rattling investors. The situation intensified when EY stepped down as the company’s auditor, stating they could no longer rely on management’s representations or complete their audit under existing obligations. This is a significant red flag that’s hard for even the most bullish investors to ignore.

SMCI Has Excellent Upside Potential and Very Good Safety, But Poor Timing Means It’s Time to Sell

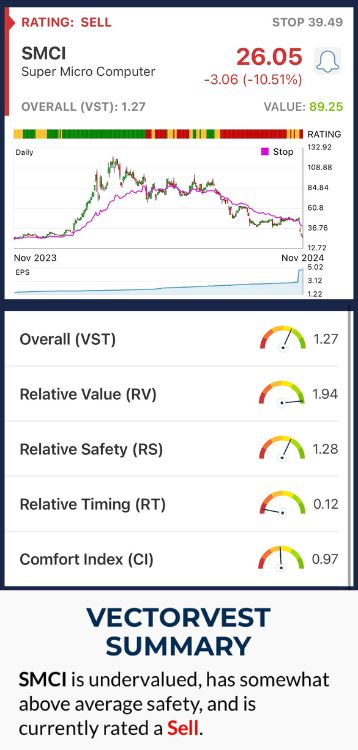

VectorVest is designed to streamline your analysis and help you make data-driven decisions quickly. It breaks down each stock using three key ratings: relative value (RV), relative safety (RS), and relative timing (RT). Here’s how SMCI fares:

- Excellent Upside Potential: The RV rating is a far superior indicator than the typical comparison of price to value alone. It goes further, comparing a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. The RV rating of 1.94 is excellent for SMCI. The stock is undervalued, with a current value of $89.25.

- Very Good Safety: The RS rating is a risk indicator. It’s derived from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. With an RS rating of 1.28, SMCI has demonstrated financial stability in terms of consistency and predictability.

- Very Poor Timing: The RT rating of 0.12 highlights a weak current trend, reflecting the recent steep declines and negative momentum. This suggests that while SMCI may have strong fundamentals, now is not the time to buy. Its overall VST rating of 1.27 marks it as a "Sell" until signs of recovery emerge.

With an overall VST rating of 1.27, SMCI is still considered very good, but due to its poor timing, it’s rated a SELL by VectorVest. Until there’s a more stable, positive trend in its price, caution is advised.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Despite having excellent potential on paper and solid safety indicators, SMCI’s timing and current issues make it a risky bet. The uncertainty surrounding the company’s financial integrity and the outcome of the DOJ probe create a challenging environment for investors.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment