Shares of Super Micro Computer (SMCI) surged an impressive 27% on Tuesday, reaching a two-week high, after the company announced it had hired a new auditor and submitted a plan to regain compliance with Nasdaq’s listing requirements. The company’s stock had been struggling following a series of challenges, including delays in filing financial reports and a potential delisting risk. However, the recent developments have fueled investor optimism, as the company looks to return to stability.

Super Micro’s move to appoint BDO USA as its new auditor and the submission of its compliance plan to Nasdaq came just ahead of the deadline. The company faces a critical decision from Nasdaq regarding its listing status. If the exchange accepts the plan, Super Micro will likely receive an extension to file its outstanding reports, providing the company with additional time to get its financials in order.

The stock’s impressive rally follows months of uncertainty. Super Micro had been under investigation by the Department of Justice, and its previous auditor, Ernst & Young, resigned due to concerns over financial transparency. Despite these setbacks, Super Micro remains a key player in the growing AI and data center markets, with strong relationships with major companies like Nvidia.

With its compliance plan in place and a new auditor on board, investors are optimistic that Super Micro can return to a more stable financial footing. But does this stock still have upside potential, or is it time to pull back? We’ve analyzed SMCI using VectorVest to provide clear insights.

SMCI Has Excellent Upside Potential, Fair Safety, and Poor Timing – Here’s Why It’s Rated a SELL

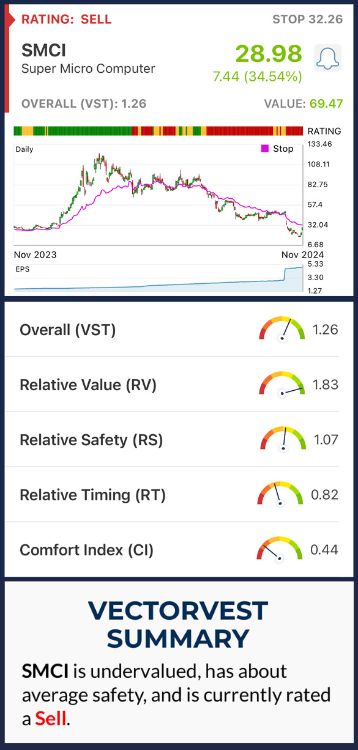

Using the VectorVest system, we find that SMCI has excellent upside potential but struggles with poor timing at the moment. Here’s a breakdown of the key ratings:

- Excellent Upside Potential: The RV rating is a far superior indicator than the typical comparison of price to value alone. It goes further, comparing a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk.The RV rating of 1.83 indicates that SMCI has excellent long-term price appreciation potential.

- Fair Safety: The RS rating is a risk indicator. It’s derived from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.07 is very good for SMCI.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 0.82 shows poor timing, meaning the stock is currently underperforming in terms of price movement. Despite the recent rally, the stock has not shown consistent momentum in its price movement over time.

The overall VST rating of 1.26 is very good for SMCI, but the stock is still rated a SELL in the VectorVest system, and will likely remain so until a more positive, meaningful price trend forms.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. While SMCI has excellent upside potential and fair safety, the poor timing makes it a stock to avoid for now. The stock is rated a SELL in the VectorVest system, indicating that investors should be cautious before jumping in, despite the recent surge.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment