THE OPTIMUM DRIP ADVANTAGE

Written By: Stan Heller

Dividend reinvestment through a Dividend Reinvestment Plan, or DRIP, is an attractive strategy, especially for young investors with an eye on creating a secure retirement. You can find a list of DRIPs in VectorVest’s Special WatchLists folder.

A third-party website such as dripprimer.ca offers additional information about DRIPs, including those with discounts. Still, you are well-advised to do your own homework. Companies sometimes change their DRIP plans when economic circumstances warrant it. Once you narrow down a list of quality stock candidates using VectorVest, call the company or your broker to confirm the DRIP information before finalizing your decision.

DRIPs deliver long-term compounding, a celebrated investing principle. They allow investors to receive their dividends in the form of shares rather than cash, taking full advantage of the power of compounding. There are plans with no commissions on the dividend shares, rounding up, or another method of providing a discount.

Typically, you would set up an automatic payment to add to your position each quarter. This method of dollar-cost averaging is another sound principle for long-term investing.

Some companies, but not all, offer a share purchase plan (SPP). This allows investors to buy additional shares directly from the company with no commissions or brokerage fees. Your portfolio grows steadily over time, assuming you choose your company wisely. That’s where VectorVest comes in.

There are currently 69 stocks in the DRIPS WatchList. I suggest you use graphs to narrow down your choices. Choose the NPI Near Perfect Indicator layout and click the 10y shortcut at the bottom right. A 10-year Weekly graph opens. From there, remove the MA RT 5 and 40; we are looking for long-term performance here. Add EPS and DIV to the subgraph as shown below.

The objective is to find the DRIPs with the smoothest Price, EPS and Dividend increases from bottom left to top right. Once you have your top choices, take the next step and follow up with the company or your broker to find out which one has the best DRIP plan to suit your needs.

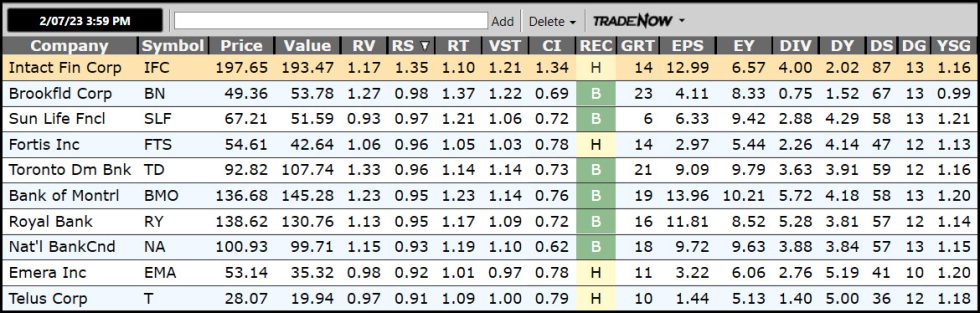

Below are my top 10 choices after a graph study. Intact Financial (IFC) tops my list. It not only has the smoothest PRICE, EPS and DIV, but it also has the highest Relative Safety (RS) and Dividend Safety (DS) scores. Granted, its current yield is substantially lower than the rest, other than Brookfield Corp (BN). However, IFC has the best DS at 87 on a 0-99 scale and the highest forecasted annual Dividend Growth (DG) rate at 13%, tied with BN and SLF (Sun Life).

All 10 stocks trade on the TSX and have options. Below is VectorVest’s analysis from the Stock Viewer, sorted by RS.

Finally, the QuickTests below show the Price gains, not including dividends, over the previous 10 years, 5 years and 2 years to February 7, 2023. I give IFC full marks for consistency.

Your choices may be different from mine, but one thing is clear. VectorVest is an essential source to help you make the right decision to get THE OPTIMUM DRIP ADVANTAGE.

Leave A Comment