Shares of Tyson Foods (TSN) are all over the place this Monday morning after the company reported a mixed bag in 4th quarter earnings coupled with a lackluster guidance for the upcoming year.

Shares moved nearly 3% lower in pre-market trading, then climbed 4% at the opening bell, all before falling back down to around a 2% loss as of 12 PM EST.

The company has struggled with weakening demand for meat in the US, and the results from the 4th quarter reflect that. Tyson Foods CEO Donnie King says that economic headwinds are presenting quite the challenge, but that the company is focusing on what it can control and becoming more efficient from an operational perspective. He feels confident in the company’s leadership team and strategy.

Revenue of $13.35 billion narrowly missed the analyst consensus of $13.71 bullion. It also represented a nearly 3% loss from this time last year. While chicken sales were up slightly and pork sales fell relatively flat, beef sales suffered nearly 7% for the quarter.

Adjusted earnings saw a big drop as well, down 77% year over year to just 37 cents a share. However, this did outperform the analyst consensus of 29 cents per share.

The real concern, though, is the weak forecast the company issued for 2024. Tyson Foods is projected revenue of $52.8 billion, which is flat year over year. This is also a bit below the Wall Street forecast of $54.4 billion.

TSN has now fallen more than 16% in the past 3 months, with no real optimism of a turnaround in sight for the stock. So, should investors view this report as a sign to get out of the stock and cut losses? Or, is there any reason to hold onto hope that things will get better in the near future?

We’ve taken a look at TSN through the VectorVest stock analysis software and found 3 things you need to see before you do anything else.

Despite Poor Earnings and Guidance, TSN Still Has Fair Upside Potential, Safety, and Timing

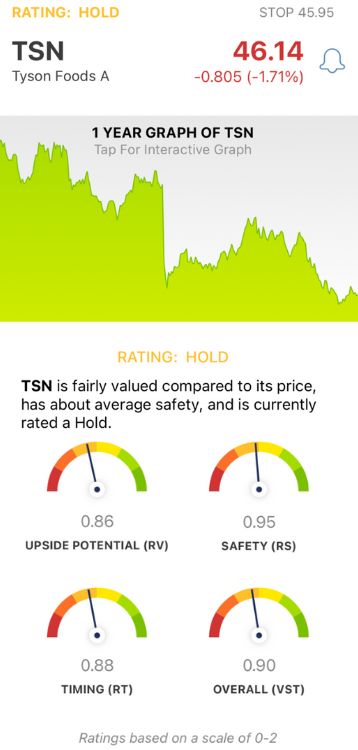

VectorVest simplifies your trading strategy by giving you clear, actionable insights through a proprietary stock-rating system. You’re given all the information you need in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on its own scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. To make things even easier, though, you’re given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time.

As for TSN, here’s what we found:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out) to AAA corporate bond rates and risk. It offers far superior insights than a simple comparison of price to value alone. As for TSN, the RV rating of 0.86 is a ways below the average but deemed fair nonetheless. The stock is fairly valued at its current price.

- Fair Safety: The RS rating is an indicator of risk derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, price volatility, sales volume, and other factors. TSN has a fair RS rating of 0.95 as of now.

- Fair Timing: Despite suboptimal performance recently, TSN still has fair timing - although the RT rating of 0.88 is a ways below the average as well. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.90 is below the average itself but still deemed to be fair. So, where does that leave investors or prospective traders?

For the time being, VectorVest has placed a HOLD recommendation on TSN. Learn more about this stock and the system itself through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Although TSN did struggle in the final quarter of 2023 and is forecasting a similar performance in the year ahead, the stock has fair upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment