Walmart’s (WMT) stellar Q3 performance was driven by growth across all business segments. Net income reached $5.1 billion, or 60 cents per share on an adjusted basis, significantly exceeding the consensus estimate of 53 cents. E-commerce sales jumped 21%, with Sam’s Club seeing a 4.6% increase in sales.

The company also saw international sales grow by 12.1%, underscoring the strength of its omnichannel strategy. Despite concerns around inflation, Walmart’s strong margins were supported by its ability to manage costs and maintain a diversified product mix.

Promising Outlook

For Q4, Walmart is projecting adjusted earnings between 62 and 65 cents per share, in line with analysts’ expectations. Full-year earnings per share are expected to be at the higher end of the guidance range, or possibly exceed it, reflecting the company’s continued confidence in its growth trajectory.

Strategic Initiatives Driving Growth

Walmart’s newly introduced private food brand, Bettergoods, is already contributing to performance. With more than 70% of its products priced under $5, the brand taps into customer demand for affordable, high-quality options. Additionally, Walmart’s evolving customer base now includes a significant portion earning over $100k annually, showcasing the company’s growing appeal across income demographics.

WMT Has Good Upside Potential, Safety, and Timing

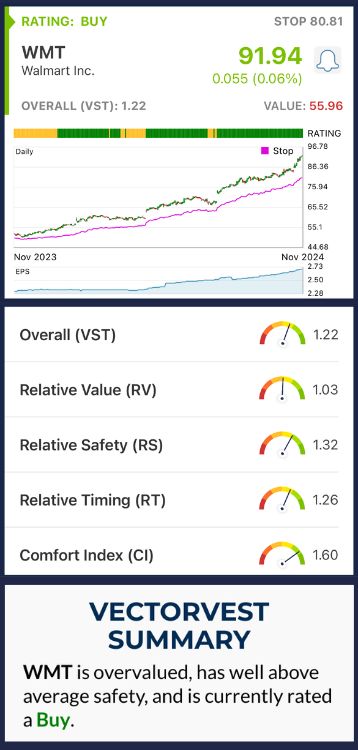

VectorVest simplifies your investment strategy by taking complex technical indicators and financial data and distilling them into just 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. Based on the overall VST rating, you’re given a clear buy, sell, or hold recommendation for any stock at any given time. Here's what we found for WMT:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers much better insight than a simple comparison of price to value alone. The RV rating of 1.03 is good for WMT, suggesting solid long-term growth potential.

- Good Safety: The RS rating is a risk indicator derived from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. WMT has a good RS rating of 1.32, reflecting strong financial stability and low risk.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. WMT’s RT rating of 1.26 suggests solid price momentum and favorable market timing.

The overall VST rating of 1.22 is good for WMT, making it a BUY recommendation in the VectorVest system.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. WMT’s recent earnings beat, solid growth across key segments, and optimistic guidance suggest the company is well-positioned for the future. The stock’s solid upside potential, strong safety metrics, and good timing make it a strong buy for investors looking for stability and long-term growth.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment