As the owner of a thriving and successful window cleaning business, Mike Simonato doesn’t have as much time as he would sometimes like to dedicate to his investing. “I have to keep things simple,” he says. “I can’t do day trading or swing trading, so I look for quality companies with very low risk. Something that I can manage with my busy schedule and sleep well at night.”

Mike, a VectorVest subscriber for four years, shared his My Three Friends system with our VectorVest Community during Saturday’s International Online Forum. You can click here to view the replay of this outstanding presentation.

“Brian D’Amico brought out this past week in an online webinar that your system determines your success,” Mike told Forum attendees. “I believe it’s very important that we have system that we can understand and one that works for our particular situation. And it’s very important to stick to that system as well, because just as Brian said, Your System Determines Your Success.”

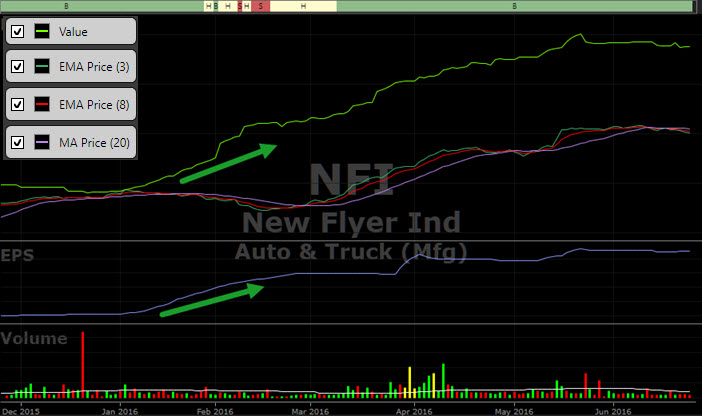

Mike shared his system for analyzing stocks and managing his portfolio and thanked the ‘wonderful members’ of our VectorVest Community for their help and guidance. Mike’s My Three Friends systems refers to a graph set-up that he uses. It completes the total portfolio management system which he uses that also includes WatchLists as he explained in a Forum presentation last December. Click here to view the Dec 2015 Forum replay.

Below are the key pillars of Mike’s My Three Friends system:

- Value must be rising.

- Price must be rising, determined by 3 and 8 EMA and 20 MA.

- EPS must be rising.

- use the Confirmed Up signal for when to buy.

- use your Three Friends graph system for when to sell.

- start with a weekly graph to study the long term trend.

- drill down to a daily graph to determine precise entry and exits.

- make sure at least two of my Three Friends agree before you BUY.

- if two of my Three Friends say get out, then you have to SELL and get out.

WHERE’S GOLD GOING? On Nov. 11 in the Views, Dr. DiLiddo wrote, “Don’t give up on gold and silver. There are plenty of geo-political risks ahead and gold prices will rise again. View Cathy O’Nan’s excellent Special Presentation on buying gold ETFs and then join us Tuesday, Dec. 6 at 12:30 pm Eastern / 9:30 am Pacific for our weekly SOTW Q&A. We’ll discuss Cathy’s presentation, answer your questions, and reveal what’s been working well in our mining rich market in Canada. Click Here To Register. Register in advance to receive the recording.

WHERE’S GOLD GOING? On Nov. 11 in the Views, Dr. DiLiddo wrote, “Don’t give up on gold and silver. There are plenty of geo-political risks ahead and gold prices will rise again. View Cathy O’Nan’s excellent Special Presentation on buying gold ETFs and then join us Tuesday, Dec. 6 at 12:30 pm Eastern / 9:30 am Pacific for our weekly SOTW Q&A. We’ll discuss Cathy’s presentation, answer your questions, and reveal what’s been working well in our mining rich market in Canada. Click Here To Register. Register in advance to receive the recording.DISCLAIMER: The information contained in this Blog is for education and information purposes only. Example trades must not be considered as recommendations. You should always do your own analysis and invest based on your own risk tolerance, investment style, goals and time horizon. There are risks involved in investing and only you know your financial situation, risk tolerance, financial goals and time horizon.

Thanks

Another awesome Forum. Thank’s to Mike Simonato for sharing his way of trading with the VV community. Let’s not forget all the previous presenters. I have learned so much in all these monthly Forums. Thank you all. Can hardly wait for the next one.

A special thank you to Stan for always going the extra mile to make us better Investors.

We are so lucky to have you Stan. The weekly Q&A sessions are a true bonus to the VV subscription .

Werner

Thank-you sincerely for your kind words Werner. I agree we are very fortunate to have so many members of our VectorVest community who are will to give us their time and share their investing knowledge with the rest of us. Wishing you all the best.