Written by: Angela Akers

Talk of a recession resurfaced late last week following some downtrodden economic data and Friday’s sell-off continued Monday. As I’m sure you’re all aware, the rest of this week has been a rollercoaster ride. Just 7 trading days into August, the Major Indices have lost an average of 3.8% and the Price of the VVC has fallen 4.2%. Ouch.

With this contraction and the political chaos abreast, I thought it would be a good time to remind you that fear is an investor’s enemy and with VectorVest, regardless of what the market is doing, you can attain success in the stock market. Whether you are new to VectorVest and investing or a seasoned long-term subscriber, there are a few important steps that you never want to overlook and many do. So, if you find yourself still invested and questioning what you should do despite the Confirmed Down that we received this week, or you’re just getting started with VectorVest, let’s review the steps we believe are necessary to be successful in the market. These steps will help you assess the stocks in your portfolio and determine what to do now.

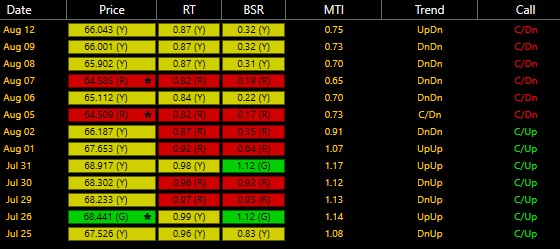

First and foremost, build a WatchList of the stocks that you currently own. Building a WatchList allows you to objectively analyze your current positions as your holdings will automatically be sorted and ranked by our master indicator, VST-Vector. VST combines the power of both fundamental and technical analysis, merging the VectorVest proprietary indicators of Relative Value, RV, Relative Safety, RS and Relative Timing, RT into one powerful indicator. Your best performing, high VST, B-rated stocks will be at the top of the list and your worst performing, low VST, S-rated stocks will be at the bottom. You can also quickly sort your WatchList by RT Desc. This will put the stocks that have been beaten down the most at the bottom of your list.

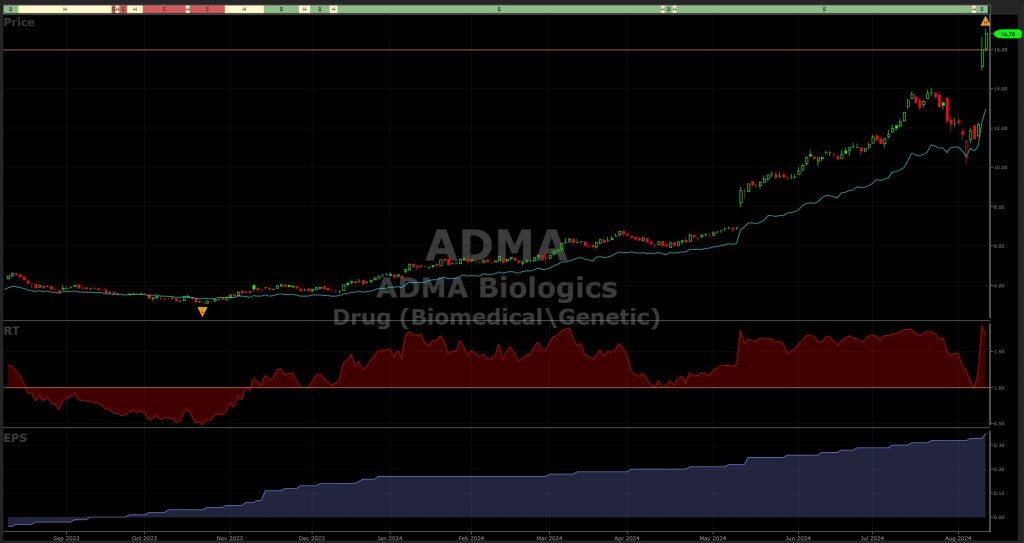

Next, graph the stocks in your WatchList. A picture is worth a thousand words and Graphs don’t lie. Use the VectorVest Simple Graph Layout showing Price, Stop, RT and EPS. Focus on the lowest RT, S-rated stocks first. The graph will plainly show you that the low RT, S-rated stocks’ prices are below their Stop Prices. If the Price movement has been falling from the upper left to lower right and the stock is still heading lower, again, you should consider selling it. As Dr. DiLiddo said, “Selling is not fun, but it must be done!” When the market is selling off, like it has been, you’ll find that it is better to cut your losses and/or take profits. That way, you will have money to do some bargain hunting when the time is right.

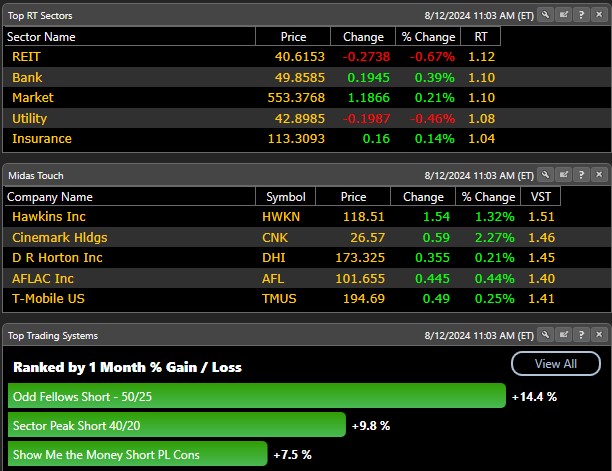

To know when the time is right, Heed the Color Guard. The single most important factor that any investor needs to know before they buy anything is market direction, as I said last week, everything follows from that. Don’t buck the trend, let the trend be your friend. When Red lights dominate the Color Guard, as they have for the last several weeks, investors should not buy stocks. When Yellow lights dominate the Color Guard, investors should proceed with caution. When Green lights dominate the Color Guard, investors may buy stocks long. VectorVest believes in buying safe, undervalued stocks rising in price when the market is rising. Please never buy stocks when the market is falling. For more detailed guidance on Market Timing, please join us in our All New VectorVest Investor Community Room for our LIVE Daily Color Guard Report at 3:55 pm EST Monday – Thursday and our LIVE Timing the Market session Fridays at 3:55 pm EST.

When the Color Guard signals and it is time to replace those low VST, S-rated that you sold, you don’t have to look too far, just Exploit the Home Page. On the Home Page, you will find the fastest moving Business Sectors and Industry Groups. Buying rising stocks in rising Business Sectors and Industry Groups adds another essential layer. You’ll also see the Top 5 Midas Touch stocks and the Top Trading Systems ranked by 1 Month % Gain/Loss (showing you the Trading Systems that are working right now).

Also, in times of market volatility, it is important to not only know how to protect your profits, but also how to mitigate risk. This week’s “Special Presentation” can help you in that regard. You do not want to miss it!

While the market swings between peaks and valleys, I think it is imperative for us, as investors and students of the market, to continue to learn and grow. All of these short tasks are quick ways for you to realign your portfolio and potentially, your thinking. Additionally, our Education team is once again offering our Successful Investor Course FREE to all of our subscribers. Consider taking this course, the only cost to you will be your time. A small price to pay to Invest In Yourself.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment